What is a Good Credit Score?

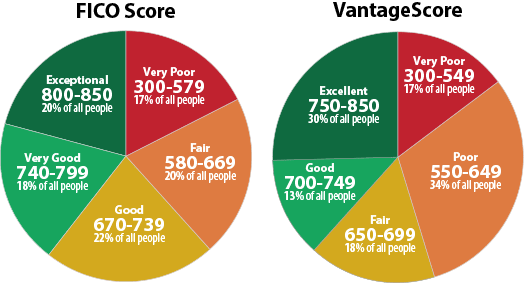

FICO Score Vantage Score

What is a Good Credit Score?

For a score with a range between 300-850, a credit score of 700 or above is generally considered good.

A score of 800 or above on the same range is considered to be excellent.

Most credit scores fall between 600 and 750.

Higher scores represent better credit decisions and can make creditors more confident that you will repay your future debts as agreed.

Credit scores are used by lenders, including banks providing mortgage loans, credit card companies, and even car dealerships financing auto purchases, to make decisions about whether or not to offer your credit (such as a credit card or loan) and what the terms of the offer (such as the interest rate or down payment) will be. There are many different types of credit scores. FICO® Scores and scores by VantageScore are two of the most common types of credit scores, but industry-specific scores also exist.

What is a Good FICO Score?

One of the most well-known types of credit score are FICO Scores, created by the Fair Isaac Corporation. FICO Scores are used by many lenders, and often range from 300 to 850. A FICO Score above 670 is considered a good credit score on these models, and a score above 800 is usually perceived to be exceptional.

What is a Good Vantage Score?

Scores by VantageScore are also types of credit scores that are commonly used by lenders. The VantageScore was developed by the 3 major credit bureaus including Experian, Equifax, and TransUnion. The latest VantageScore 3.0 model uses a range between 300 and 850. A VantageScore above 700 is considered to be good, while above 750 is considered to be excellent.

Factors That Affect Your Credit Scores

The information that impacts a credit score varies depending on the scoring model being used. Credit scores are generally affected by elements in your credit report, such as:

The information that impacts a credit score varies depending on the scoring model being used. Credit scores are generally affected by elements in your credit report, such as:

- Payment history for loans and credit cards, including the number and severity of late payments

- Credit utilization rate

- Type, number and age of credit accounts

- Total debt

- Public records such as bankruptcy, civil judgments, or tax liens

- How many new credit accounts you’ve recently opened

- Number of inquiries for your credit report

- Most influential: Payment history on loans and credit cards

- Highly influential: Total debt and amounts owed

- Moderately influential: Length of credit history

- Less influential: New credit and credit mix (the types of accounts you have)

VantageScore Factors:

- Most influential: Payment history

- Highly influential: Age and type of credit, percent of credit limit used

- Moderately influential: Total balances and debt

- Less influential: Recent credit behavior and inquiries, available credit

- Your race, color, religion, national origin, sex or marital status (U. S. law prohibits credit scoring formulas from considering these facts, any receipt of public assistance or the exercise of any consumer right under the Consumer Credit Protection Act.)

- Your age

- Your salary, occupation, title, employer, date employed or employment history (However, lenders may consider this information in making their overall approval decisions.)

- Where you live

- Certain types of inquiries (requests for your credit report). The score does not count “consumer disclosure inquiry,” which is a request you have made for your own credit report in order to check it. It also does not count “promotional inquiry” requests made by lenders in order to make a “preapproved” credit offer or “account review inquiry” requests made by lenders to review your account with them. Inquiries for employment purposes are also not counted.

Free Credit Score and Report

Get your VantageScore® 3.0 credit score

powered by TransUnion®.

It's free.

CHASE BANK

https://creditcards.chase.com/free-credit-score?CELL=68GQ

Your credit scores should be free. And now they are.

Check your scores anytime, anywhere, and never pay for it.

https://www.creditkarma.com

10 Best Credit Reporting of 2018

After reviewing all of the best credit reporting services, we found that the quality of their reports, monitoring services, available plans, and reputation matter most.https://www.consumersadvocate.org/credit-reporting/a/best-credit-reporting

Cabaret

Get your VantageScore® 3.0 credit score

powered by TransUnion®.

It's free.

CHASE BANK

https://creditcards.chase.com/free-credit-score?CELL=68GQ

Your credit scores should be free. And now they are.

Check your scores anytime, anywhere, and never pay for it.

https://www.creditkarma.com

10 Best Credit Reporting of 2018

After reviewing all of the best credit reporting services, we found that the quality of their reports, monitoring services, available plans, and reputation matter most.https://www.consumersadvocate.org/credit-reporting/a/best-credit-reporting

- Our #1 choice, with an A+ rating by BBB

- Experian credit report is fompletely FREE

- TRULY: No credit card required

- Checking your own report doesn’t hurt your credit

- Report refreshed every 30 days on sign up

Cabaret

"Money"

No comments:

Post a Comment